Nike is ticking boxes for investors

- Reggie Barker

- Jun 28

- 2 min read

Despite the athletic apparel company reporting their smallest profit since 2020, Nike is still managing to tick boxes for investors.

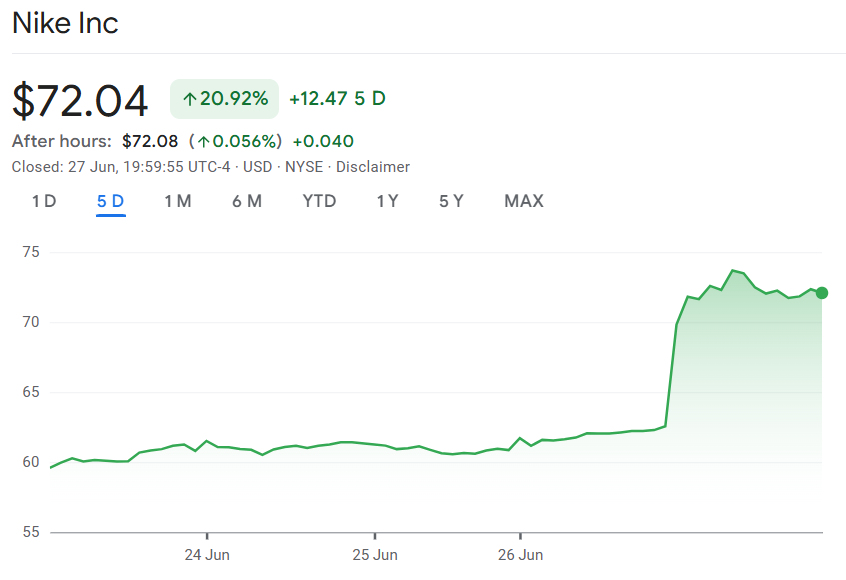

On June 27th, Nike experienced their third-biggest daily gain in history.

This comes as Nike’s stock is still recovering from its 5-year low reached this March due to projected expenses from Trump’s tariffs.

Despite reporting an 86% drop in revenue from the same time last year and projecting costs of around $1bn from Trump’s tariffs, investor sentiment is rebounding from that low.

Nike CFO, Matthew Friend, has plans to diversify Nike’s operational footprint from heavily tariffed countries such as China and Vietnam.

Investors are taking well to this news, as it will begin to reduce the burden of the $1bn tariff cost Nike would otherwise be facing.

Furthermore, the sportswear company plans to combat the cost burden by passing it back to consumers.

Despite the typically unpopular nature of rising prices for consumers, this may be feasible for Nike as they can exploit recent fashion trends surrounding the brand.

Over recent years, Nike has been seen as ‘in’, with Bloomberg highlighting that they could even acquire ‘luxury’ status.

With that status, Nike gains a certain price setting power. Luxury consumers are prepared to pay for more than just a product’s practical worth, they are paying for the social status of the brand.

Ironically, this can create a somewhat virtuous cycle for luxury brands, where the more they raise prices, the more consumers perceive the brand as exclusive and so the more they are willing to pay, defying all rules of price and demand.

While it is unlikely that Nike is going to be stumbling upon the ability to infinitely raise their prices, on a smaller scale it is very helpful that fashion trends can allow Nike to dodge the brunt of tariff-based costs.

That is almost certainly what is ticking investors’ boxes.

Comments